With a new year underway and the cost of living continuing to increase at a pace, and the knock-on effect of this to most services and products, investors are understandably looking for ways to ensure they capture the best investment returns where possible. But where should you start with this?

Can you use historic performance to predict future performance?

Many investors still attempt to chase the best performing countries, sectors and funds, selling assets that have fallen out of favour and buying the newly touted ‘best buys’, often based on historic performance.

Many professional investors and fund managers believe they have the ‘skill’ to do this.

However, whilst there are lessons that can and should be learned from historic data, many decades of academic research show that the manager’s ‘skill’ is more often likely to be ‘luck’, and that repeat ‘luck’ is almost unheard of.

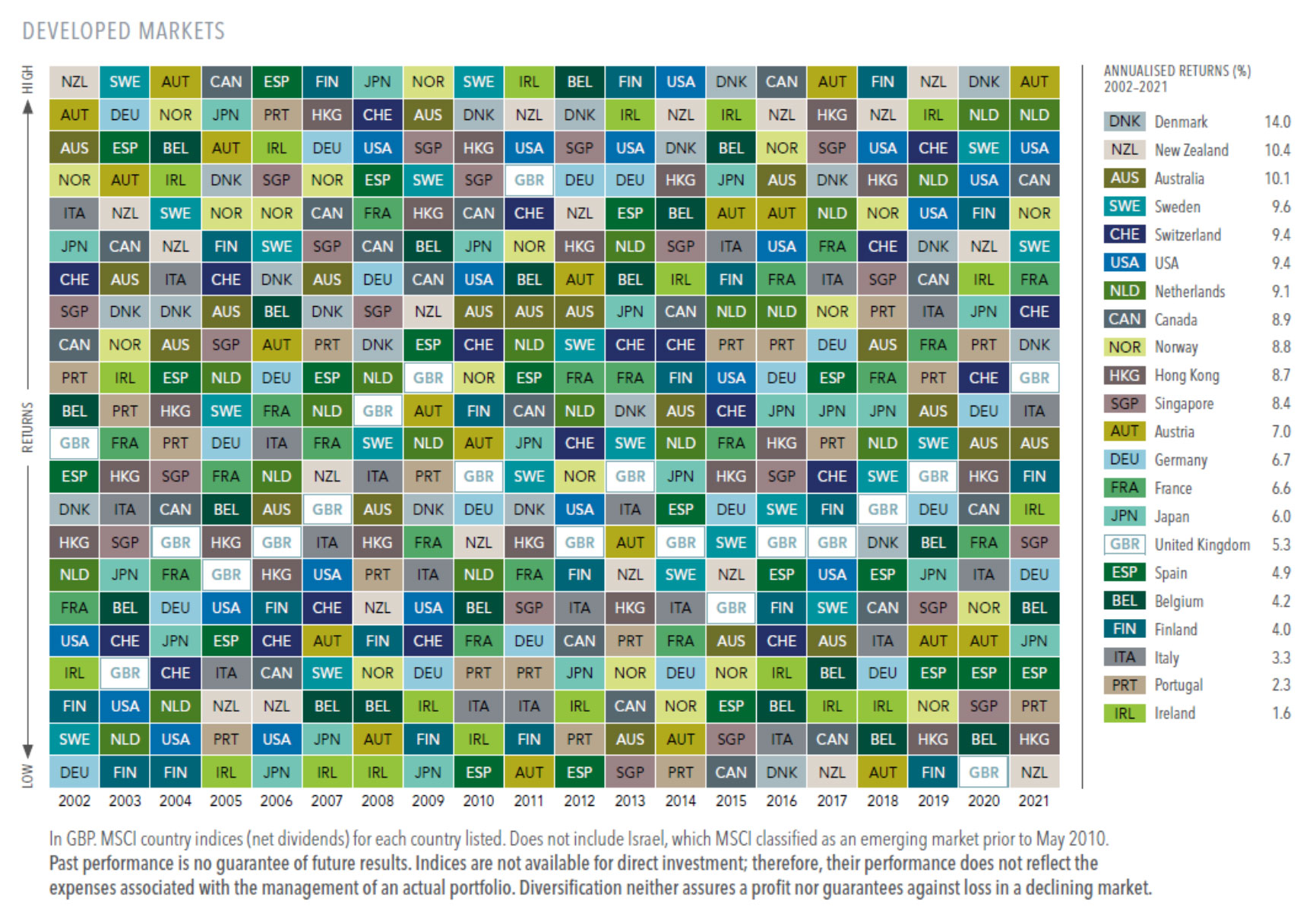

Dimensional Fund Advisors have compiled the following chart, showing the Randomness of Returns. The chart focuses on the performance of global markets, by country, since 2001.

Randomness of Global Stock Market Returns

Source: Dimensional Fund Advisors, Randomness of Global Stock Market Returns

This chart demonstrates, clearly and colourfully, that it is very hard to predict which country will outperform from one year to the next, taking Austria as an example – they produced the highest developed market return in 2017, but the lowest in 2018.

Similarly, markets have returned on average about 10% a year, although almost never that amount in any given year. So, like trying to pick the winning country, asset or company, we don’t advocate trying to predict or outsmart (i.e. time) the market.

So, how should investors deal with this?

Our investment philosophy is based on buying the whole market, with a diversified global portfolio.

Whilst you would have still seen the losses in your Austria assets in 2018, you would also have had the positive returns from the Finnish market (the top performers in that year). Holding all (or almost all) of the market can help to provide more reliable outcomes over time.

Dimensional’s research shows that ‘buying the market’ and holding over the longer-term has provided better outcomes for investors, than trying to pick the winners and losers individually.

Our message to our clients is clear – “don’t try to time the market, and don’t try to pick the winners and losers”. A solid, long-term financial plan, taking no more risk than you are comfortable with, will stand you in very good stead, allowing you to concentrate on the people and goals that really matter to you.

Dimensional say that “the market is a great information processing machine. It runs on human ingenuity, which is why returns tend to grow over time as people work to innovate and improve the value of the companies they work for. So start the new year off with a clean slate—just like markets do every day.”

Invitation

Interested in discussing the chart in more context to your own financial planning? Get in touch today to arrange a free, no-commitment consultation with our team here at WMM.

You can call us on 01869 331469.

Recent Comments