If you are fortunate enough to receive a bonus this year, you may be considering ways to save tax. While a cash windfall is always welcome, your bonus might push you into higher rates of tax, meaning that you receive less than you were expecting.

Below, we explain how your bonus is taxed and some options for making savings.

Your Bonus – Tax Treatment

If you receive a bonus, this is added to your other income for the tax year to calculate your tax liability. This means you will pay tax on your bonus at your highest marginal rate.

National Insurance will also apply and if you have any other deductions from your salary, such as student loan repayments, these will also factor into the calculation.

A key point to be mindful of is that receiving a bonus can push you into the next tax band. Going from basic rate to higher rate tax can mean increasing your tax bill on the bonus by up to 20%.

If your bonus takes your earnings over £100,000, you will also start to lose your personal tax-free allowance of £12,570. This can take the effective tax rate on your bonus as high as 60%, as not only are you paying higher rate tax, but you are also extending the amount of income that is taxed overall.

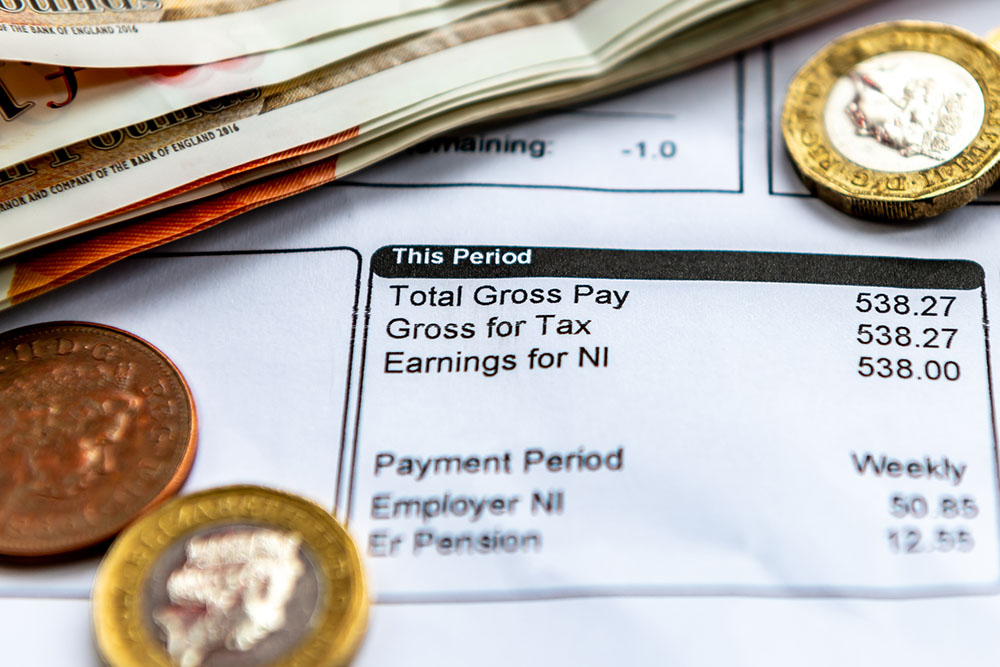

Even if you have checked the tax treatment and are comfortable with the extra tax, remember to check your pay slip for emergency tax coding. Sometimes when you receive a one-off payment, HMRC will assume you will receive the same amount every month and adjust your tax code accordingly. This means paying significantly more tax, potentially for the rest of the tax year. It is normally corrected at the end of the tax year, or you can contact HMRC to receive a refund sooner.

How You Can Save Tax by Making Pension Contributions

Making a pension contribution is one way to reduce the amount of tax you pay on your bonus.

If your employer can arrange this through salary sacrifice, the administration is fairly simple. The bonus will be paid into your pension as an employer contribution and you won’t pay tax or National Insurance on it.

If your employer makes pension contributions via the ‘net pay method,’ your tax will be automatically reduced, but you won’t necessarily receive relief from National Insurance contributions.

If your employer is unable to pay the bonus into your pension, or you decide to make the contribution later, you can arrange a personal contribution. Basic rate tax relief is credited automatically, which means that for every £80 you contribute personally, HMRC adds a further £20. This means a gross contribution of £10,000 will only cost you £8,000 from net income.

There are, of course, limits to this. Pension contributions are generally capped at your gross annual earnings or the annual allowance (£60,000), whichever is lower. However, if you earn more than the annual allowance, you may be able to carry forward allowances from up to three previous tax years. This means that higher earners receiving a large one-off bonus have considerable scope to top-up their pensions.

The limits on pension contributions and tax relief available are explained further here.

Pensions are highly tax-efficient investments and do not incur any tax when the funds are invested. Currently, you can also pass the funds to your beneficiaries tax-free if you die before age 75. After age 75, any income drawn by your beneficiaries is simply taxable at their own marginal rate.

Are There Any Downsides?

The main downside to funding your pension is that you can’t access the money until your minimum retirement age. This is currently age 55, but is expected to rise to 57, and subsequently 58 as the State Pension is also due to increase.

At your retirement age, you can take up to 25% of your pension as a tax-free lump sum. The remainder is then taxed at your marginal rate. So, while you can substantially reduce the amount of tax you pay on your bonus, particularly if you move from higher to basic rate tax in retirement, you will probably still pay some tax on it eventually if you take benefits from your pension.

There is also the chance that the investments in your pension will be exposed to market volatility. You may even lose money, particularly if you make the an investment into equities close to your retirement age.

You also need to be mindful of pension allowances. Breaching the annual allowance means not only being taxed on the money as if it was earned income, but that the money is now tied up in a pension, to be taxed a second time if you take retirement benefits.

If you earn over £240,000 or have already taken benefits from your pension, you will have a lower annual allowance.

These risks can easily be addressed by careful planning, for example:

- Keeping enough cash to cover potential emergencies and any planned spending.

- Only investing if you can hold the fund for at least five years (ideally longer).

- Investing in a suitable range of funds which is well diversified and matches the appropriate risk level.

- Taking advice on larger pension contributions, particularly if you are a higher earner.

Other Options for Saving Tax

If you have maximised your pension allowances or wish to take a different route, there are a few other options to tax-efficiently invest your bonus, for example:

- ISAs – while you don’t receive any tax relief on your contributions, all income and growth are tax-free and you can access your savings flexibly. This might be a suitable option if you are likely to need the money before retirement age and are comfortable paying tax on the bonus.

- Venture Capital Trusts (VCTs) – these offer income tax relief of 30%, providing the relief is no more than your tax bill and you hold the investment for at least five years.

- Enterprise Investment Schemes (EIS) – similarly, these schemes offer income tax relief of 30% (as well as benefits in terms of capital gains tax and inheritance tax), with a minimum holding period of three years.

- Seed Enterprise Investment Schemes (SEIS) – these are a subset of the EIS regime and offer income tax relief of up to 50%. However, they are significantly higher risk as they target very early-stage companies.

The latter three options are very high-risk investments which invest in smaller companies. While the tax relief is a strong incentive to invest, you could lose some or all of your capital.

It’s a good idea to seek tax advice if you are considering higher risk investments or tax planning, as getting it wrong can cost much more than you saved.

Please don’t hesitate to contact a member of the team if you would like to discuss financial planning and tax.