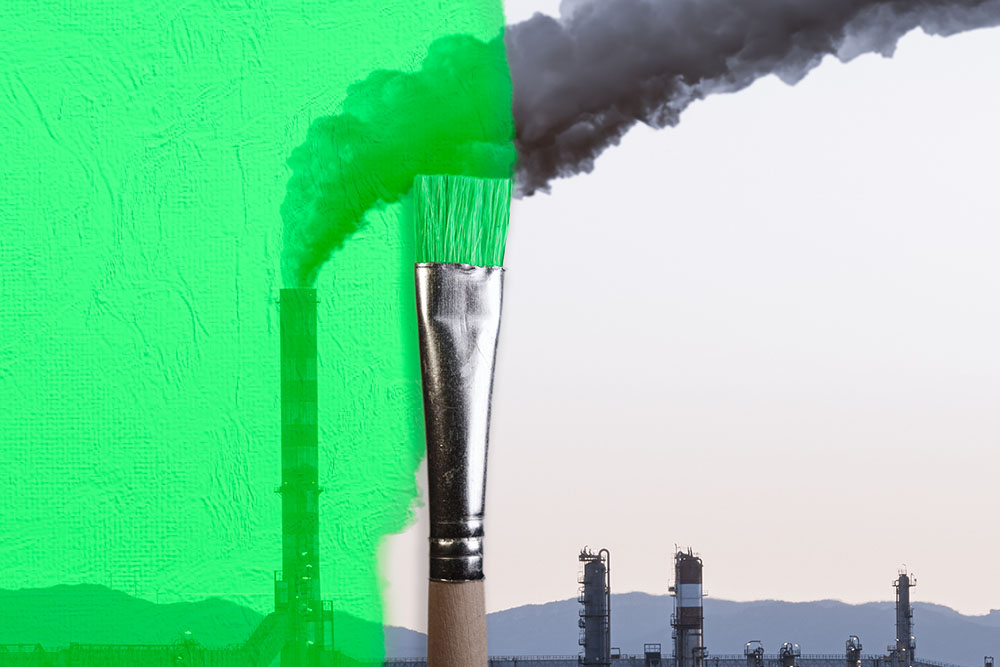

We’ve all seen companies jumping on the environmental bandwagon to make themselves look good. This makes it hard to choose if you want to be sure you’re investing ethically. Which products can you trust? Which claims are genuine?

The Financial Conduct Authority (FCA) has recently brought in new anti-greenwashing rules, however, to ensure companies do not make misleading claims about their sustainable credentials or the investment products they’re offering. The new regulations are aimed at helping customers form decisions based on open and transparent information.

This is key when Environmental, Social, and Governance (ESG) investing is a growing sector. According to the Financial Lives survey by the FCA, 81% of adults would like their investments to do some good as well as provide a financial return. So, financial firms’ marketing information needs to be accurate and not exaggerated.

What are the anti-greenwashing rules?

The anti-greenwashing rules were enacted on 31 May 2024 and apply to all FCA-regulated firms. They cover communications with UK clients and the promotion of financial products and services within the UK.

The overarching aim is to protect consumers by ensuring the sustainable products and services they are sold are accurately described.

Under the new rule, all authorised firms must ensure any sustainability claims in their marketing material are clear, fair and unambiguous. Facts must be accurate and verifiable.

Information needs to abide by the three Cs:

- Correct and substantiated – if firms are claiming an investment product is ‘green’, they need to be able to back it up with evidence. A fund promoted as ‘fossil fuel-free’ should not hold investments in companies using fossil fuels. Vague terms like ‘sustainable’ or ‘eco-friendly’ should be avoided as they are hard to prove.

- Clear and presented in a way that can be understood – firms should tailor communications to their target audiences and avoid technical jargon for individuals who are not familiar with industry terms. Visuals and language should not create misleading impressions of environmental friendliness.

- Complete with no information omitted or hidden – firms should provide a full picture, including both positive and negative aspects of their products or services. If a bond fund supports both sustainable projects and fossil-fuel efficiency improvements, missing out on the latter could be misleading.

- Comparisons to other products are fair and meaningful – firms must explain any comparisons to help customers make informed decisions. They should not cherry-pick information about their own or comparable products and services.

Previous examples of greenwashing

Tackling greenwashing has become necessary because, in the past, companies have been found to misrepresent environmental benefits.

A company might have claimed that the money raised from a green bond was being used to fund renewable energy projects when it wasn’t. Or a company might have issued a sustainability-linked bond with targets that didn’t require the company to reduce its emissions below a certain level. Or they might have issued a green bond to fund technology improvements while the improvements extended the life of oil refineries.

A wider package of legislation

The anti-greenwashing rule introduced in May was part of a whole package of legislation. On 31 July 2024, the Sustainability Disclosure Requirements regime also came into effect. This enables UK-based fund managers to use product labels to help consumers better understand what the term is being used for.

Under the new FCA rules, asset managers won’t be able to use self-styled claims but will have to choose one of four specific fund labels:

- ‘Sustainability Focus’

- ‘Sustainability Improvers’

- ‘Sustainability Impact’

- ‘Sustainability Mixed Goals’

The labels have been created to end vague and potentially misleading references to the environmental, social, and governance (ESG) impact of funds. In the past, some funds labelled ‘ESG’ were found to be invested in industries such as fossil fuels, tobacco, and fast fashion.

In fact, it is thought that more than 40% of investment funds in the EU using ESG or sustainability-related labels may be required to change their names or sell assets to comply with the new anti-greenwashing rules.

ESG funds using broad phrases like ‘green’, ‘environmental,” or “climate” will be required to meet investment thresholds by having at least 80% of their assets in investments that meet suitable sustainability characteristics.

They will also need to follow the exclusion criteria for Paris Aligned Benchmarks (PABs), meaning funds will have to collect data to show they’re not exposed to any assets involved in tobacco or controversial weapons and that fossil fuel-related activities are below a certain threshold.

Naming and marketing rules are also scheduled to come into effect from 2 Dec 24.

The consequences of not complying

Investment banks found guilty of greenwashing could face significant fines, legal costs and damage to their reputation. They may also have to offer remediation to customers, who have been mislead by their statements.

It’s important that they start to demonstrate transparency regarding their sustainability and build trust with investors.

The future

The new FCA regulations are designed to:

- Help customers understand what their money is being used for

- Improve trust in investment products

- Ensure that a firm’s environmental claims are backed up with real evidence

This should mean that in the future, investors can believe what they read about sustainable investment options. They should be able to expect clear and detailed information about the environmental or social impact of their investments rather than just vague, unsubstantiated claims.

The more stringent requirements will promote accountability among firms, encourage transparency and tackle greenwashing across the sustainable investment industry. This, in turn, will help investors to make more informed investment decisions in line with their values.