While the reduction to National Insurance rates captured the headlines, another measure announced in the Spring 2024 Budget was the introduction of a British ISA. This will offer an additional £5,000 ISA allowance for anyone wishing to invest in British assets.

The intention is to stimulate growth in the British economy while rewarding investors for buying local.

Full details are still to be announced, and the proposals are still at the consultation stage. Below, we outline what we know so far.

The Current ISA Rules

The current ISA regime has been around since 1999, with allowances remaining unchanged since 2017. The main rules are as follows:

- You can contribute up to £20,000 to an ISA.

- You can use your ISA to hold cash, stocks and shares, or a mix of both.

- All income and growth generated by an ISA is tax-free, and you can usually withdraw your money without restriction or penalty (unless you have specifically bought a product with a fixed term).

- If you take money out of your ISA, you can replace it in the same tax year without using up any of your allowance.

- ISAs can be transferred between managers, and you can switch between cash and stocks & shares.

- ISAs can be transferred to a spouse on death via an Additional Permitted Subscription.

ISAs are highly tax-efficient, and along with pensions, form an essential building block in a sensible investment an efficient financial plan.

How Will the British ISA Work?

Details are still light on how the scheme will actually work. What we know, is that investors will have an additional allowance of £5,000 to invest only in British assets. This effectively increases the ISA allowance to £25,000.

The likelihood is that the British ISA will not be incorporated into existing stocks and shares ISAs, but will be introduced as a new, separate wrapper. This means that an investor could theoretically have up to four different ISAs – cash, stocks & shares, a Lifetime ISA, and a British ISA.

A consultation is underway to nail down the specifics. This is expected to be completed by 6th June 2024.

Details Still to Be Confirmed

Firstly, between the consultation period and the upcoming election, nothing is certain. The British ISA is simply an idea at this point, with no certainty over if, or when it will come to fruition.

If it does pass into legislation, it is likely to be April 2025 at the earliest before it becomes available. This is on the basis that investment providers can offer it. Some may choose not to, and others might not enter the market right away.

There is also some uncertainty over what the scheme can invest in. Shares in listed British companies are likely to be on the list, and it has also been indicated that shares listed on the AIM market could also qualify.

It is possible that collective funds such as OEICs, corporate bonds, gilts and possibly even cash in British institutions should also qualify. There is some uncertainty over investment trusts, as these are technically listed British companies, but can invest in a wide range of global assets – it is likely that some controls will be put in place to limit the underlying investments that can be accessed.

Transfer rules are also yet to be announced. Transferring an existing ISA to a British ISA is likely to be counterproductive, as you could buy the same assets within a standard ISA. However, if it is possible to transfer out of a British ISA, investors could take advantage of the increased allowance before moving their money elsewhere to access more investment options. This might be good for investors, but defeats the purpose of encouraging investment into the British economy.

Should You Invest in a British ISA?

In theory, an additional ISA allowance offers the chance to save more and reduce your tax bill.

But not everyone uses their full ISA allowance every year. Research by Sanlam indicates that as of the 2020/2021 tax year, only 33% of investors with between £50,000 and £100,000 of investable capital used their full ISA allowance. The figure increased to 48% for those with under £50,000 and to 71% for investors with over £1 million.

For some investors, prioritising a pension is likely to offer a better return over the longer term. Pensions have more limitations, but ultimately offer a higher level of tax relief. Of course, many people have other demands on their money, including getting on the property ladder, saving for children, or simply dealing with the cost of living.

It is likely that the British ISA will benefit a relatively small segment of the investing population. Whether or not it boosts British growth remains to be seen. However, surveys indicate that around 48% of adults would consider investing in a British ISA, with this figure rising to 63% amongst existing stocks & shares ISA investors.

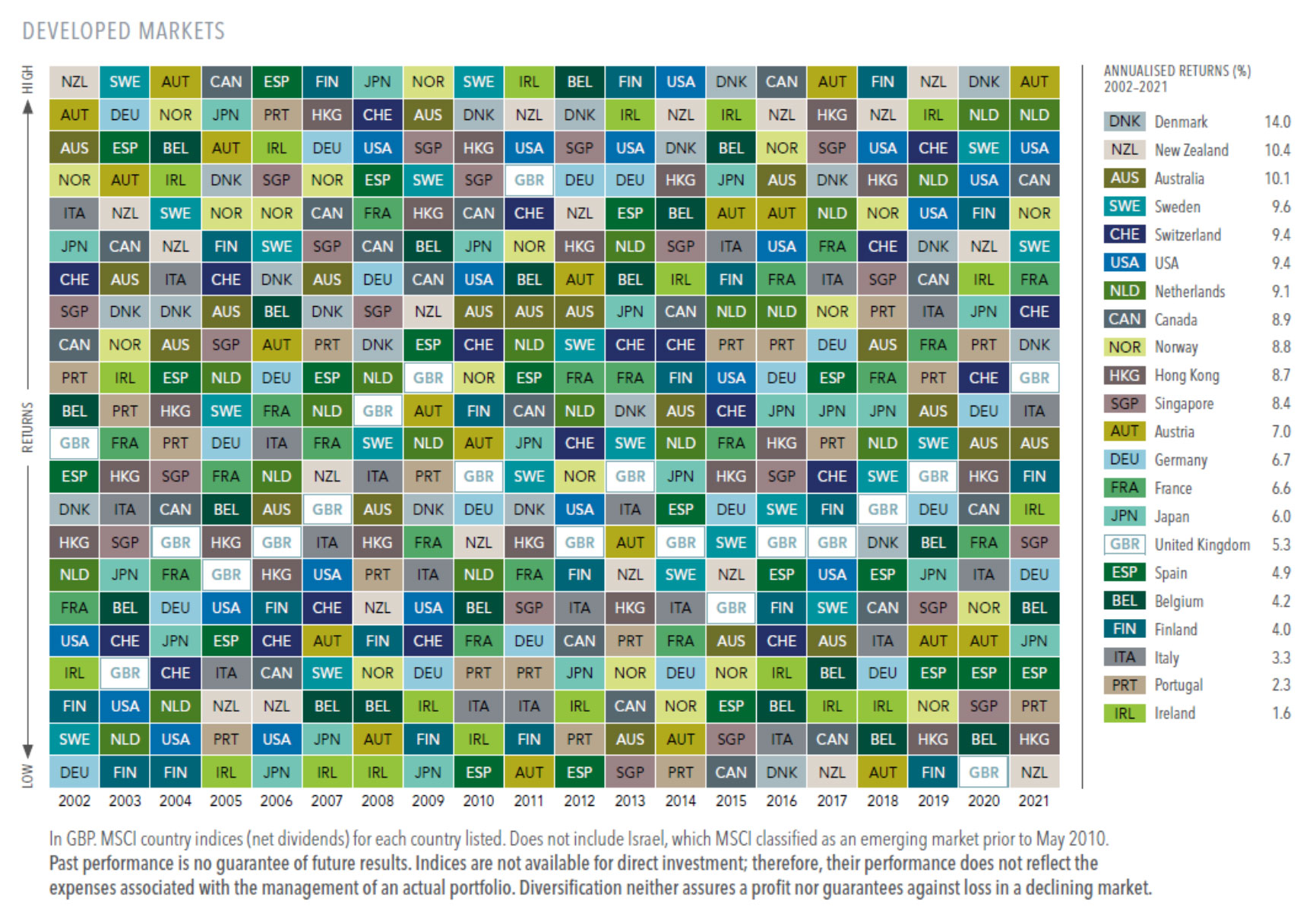

One of the risks of investing in a British ISA is concentration risk. The UK makes up around 4.1% of the global economy by market share, behind the US (58.4%) and Japan (6.3%). However, if you use your British ISA allowance every year in addition to the standard allowance, this could mean holding at least 20% in the UK. Home bias is already an issue for investors, and British ISAs could be seen to be encouraging this.

It’s important to make sure that your portfolio is well-diversified and invested at a suitable risk level. So, if you do choose to invest in a British ISA, you might want to make some adjustments to your other investments to ensure they are well-balanced.

An investment plan should not be based around new products or gimmicks. However, if a new product or tax break allows you to do what you were planning to do anyway, but with additional benefits, then it is worth considering.

Please don’t hesitate to contact a member of the team to find out more about your investment options.

Recent Comments