This content is for information and inspiration purposes only. It should not be taken as financial or investment advice. To receive personalised, regulated financial advice regarding your affairs please consult us here at WMM (financial planning in Oxford).

We believe a globally diversified portfolio provides the best chance of capturing market returns. Occasionally we are asked why equity funds in our portfolios are held on local currencies rather than being hedged back to Sterling. We think this bulletin from investment group 7iM provides a helpful explanation why this makes good financial sense, and we thank 7IM for allowing us to reproduce this.

Who stole my returns?

Financial technology lets us do wonderful things.

Within 10 minutes of opening a stocks and shares ISA, you can happily be making investments around the world. US government bonds, European ETFs, Japanese equities, whatever you like.

And lots of people do just that – diversifying abroad, and rightly so.

But they often forget that they aren’t making a single investment when they decide to do so.

They’re actually making two investments. One into the asset they want – and the second into the currency of that asset.

And we’re not talking here about Venezuela or Argentina or Turkey. We’re talking about the major currencies of major countries.

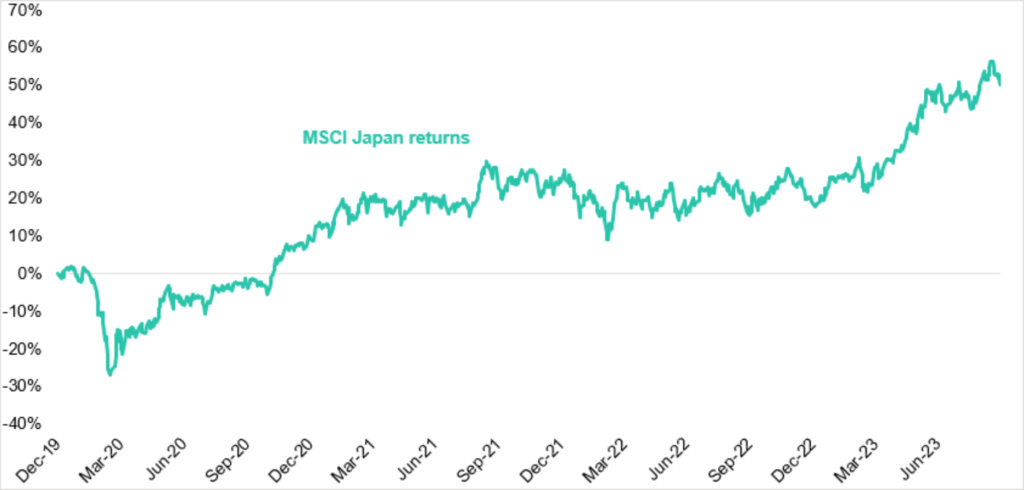

Here’s the return of the Japanese stock market since the start of 2020; the COVID wobble we saw everywhere, then a nice steady climb up to a 50% gain as of today [04/10/2023]. It’s an annual return of around 11.5%. Looks good!

Source: 7IM/Factset

And if you like your returns in Japanese Yen, it IS good.

But I suspect you probably pay for most of your stuff in GBP.

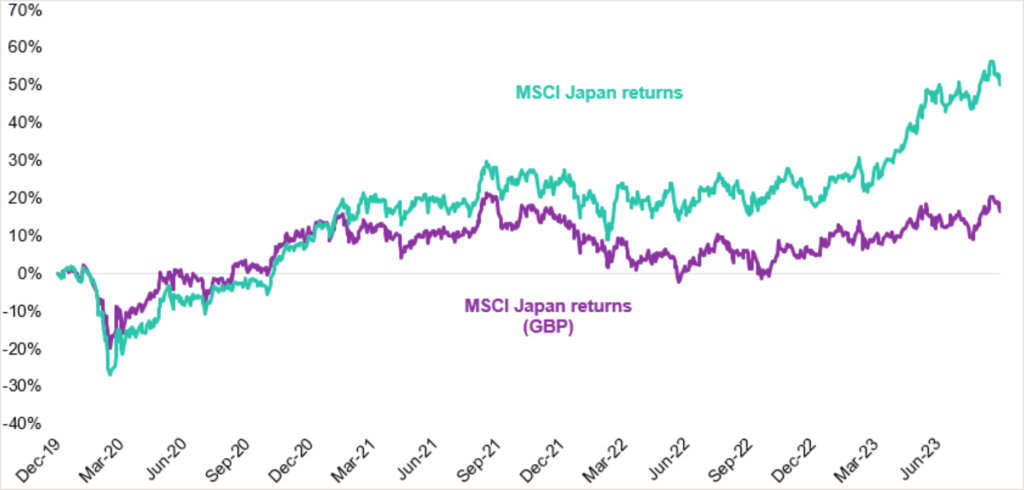

That’s what the purple line shows – the Japanese stock market returns, translated back into pounds sterling.

Source: Factset/7IM

That’s a 16% return over the period. Just over 4% annualised. The foreign exchange markets took 7% of your returns away each year!

Of course, there are periods where the currency will move in your favour too, but this highlights how variable the outcome can be when you put a border between you and your investment!

The key thing to remember is that when people talk about a market or a stock moving by x% in portfolios, that’s not the whole story. If you have to convert this back into pounds, the whole picture could change…

Invitation

Interested in finding out how we can optimise your financial plan? Get in touch today to arrange a free, no-commitment consultation with a member of our team here at WMM.

You can call us on 01869 331469