Only a few months ago no one really knew of Coronavirus. Now, no matter where you live globally, everyone knows of Coronavirus. As with any public health concern, there is a great deal of scaremongering mixed in with the genuine facts.

While many people are understandably concerned about the impact on their health, their family and the provision of medical services, we cannot escape the impact that world events have on financial markets.

So what is Coronavirus, how has it/will it affect your investments, and what should you do?

What is Coronavirus?

While we do not claim to be medical experts, the basic facts are:

- Coronavirus, or COVID-19, is a respiratory illness believed to have originated in China.

- As the illness is a virus, there is no treatment, only medications to relieve the symptoms. No vaccine is available, as yet.

- Most people who catch the virus will not be seriously ill. Elderly people, pregnant women, babies and those with compromised immune symptoms are most at risk.

- The illness is extremely contagious. NHS advice is to stay at home if you can, as this helps to stop the virus from spreading.

- Those not specifically listed as ‘most at risk’ shouldn’t really panic about the possibility of catching Coronavirus, indeed many consider it inevitable over time, although sensible precautions should be taken.

What is the Financial Impact?

In reality it is still too early to determine the true economic impact; as this will probably be a long term cost borne by future generations meeting the costs of Government spending at this time. In the short term; the impact will come from lost working hours, restricted travel and leisure spending, and demands on healthcare services for example. Some companies may even profit from a health scare, as people stock up on over-the-counter medications and non-perishable food items.

While there is no doubt that Coronavirus has impacted on share prices recently, this is exaggerated by ‘typical’ investor behaviour. One investor becomes concerned about the impact of the virus and sells their shares. This results in a small drop in the share price, which then leads other investors to become worried and possibly sell their shares. As more money is removed from the market, share prices fall across the board like dominoes. Until new ‘news’ changes the momentum, markets can be expected to remain a little volatile in the short term.

This can be worrying, particularly if you are approaching retirement, or relying on your investments to support your lifestyle. However, we have the benefit of hindsight, and can say with confidence that if the past is any indicator, the markets should bounce back fairly quickly.

What Can We Learn From the Past?

If you have held investments over the last 20 years, there will have been some points at which you were very nervous.

It is now over a decade since the sub-prime mortgage crisis, collapse of Lehman Brothers and the subsequent recession had such an impact around the world. Many were still feeling or recovering from the effects, having suffered job losses, home repossessions and ten years of austerity.

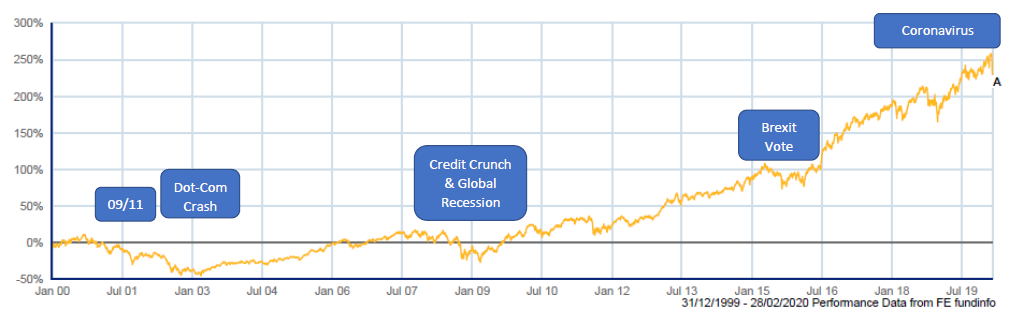

However, the markets march on, and as you can see from the chart below, the financial crisis (and various other major world events) have barely warranted a blip on an otherwise upward trajectory. There is no reason to think that Coronavirus will be any different.

Investor sentiment causes the markets to rise and fall, but ultimately, a sound investment strategy, held for the long term, is unlikely to fail.

FTSE World Index

Please do not hesitate to contact a member of the team to find out more.

Please do not hesitate to contact a member of the team to find out more.

What Should I Do?

Much of the activity in the market is driven by fear or greed, causing investors to buy and sell at the wrong times. The best strategy is to stick with the plan and weather the storm. Many investors who switched to cash or took a lower risk approach in the midst of global events, are finding that they are now worse off than if they had simply ignored the noise of the financial press.

The most successful investment strategy is the one you stick with, providing it is well-planned in the first place. A sound investment plan:

- Holds a wide range of assets from different asset classes, world regions and industry sectors;

- Is aligned with your tolerance, requirement and capacity for risk;

- Has costs under control and;

- Doesn’t react unnecessarily to world news.

Whether you have a few thousand set aside for your children in an index-tracking fund, or a multi-million pound managed portfolio, you need to keep the points above in mind. Tuning out the financial press will become much easier.

We have preached this message for many, many years, and know that this works.

Please don’t hesitate to contact a member of the team if you would like to find out more..