If you didn’t know better you may assume, probably because of constant media noise, that Stock markets globally have virtually ceased trading, and just given up. Actually, they haven’t and many of our clients have seen really good market recoveries lately. That clients have listened to and accepted the logic behind our investment philosophy is extremely reassuring to us. It has meant sitting tight, taking advantage of recent downturns, knowing that ‘this too shall pass’.

We are acutely aware that many investors will not have experienced the levels of recent volatility, however, I personally have been through around 7 of these ‘Black Swan’ events so feel confident we know what works to get people and families through the times. It really resonated with me when new National Treasure, Colonel Tom Moore said: “For all those people who are finding it difficult at the moment: the sun will shine on you again and the clouds will go away,”. Captain Tom may not know all the academic research behind key investment principles, like the one below about letting Markets work for you, but I couldn’t have put it better myself. He’s been around you know!

Let the markets do the heavy lifting

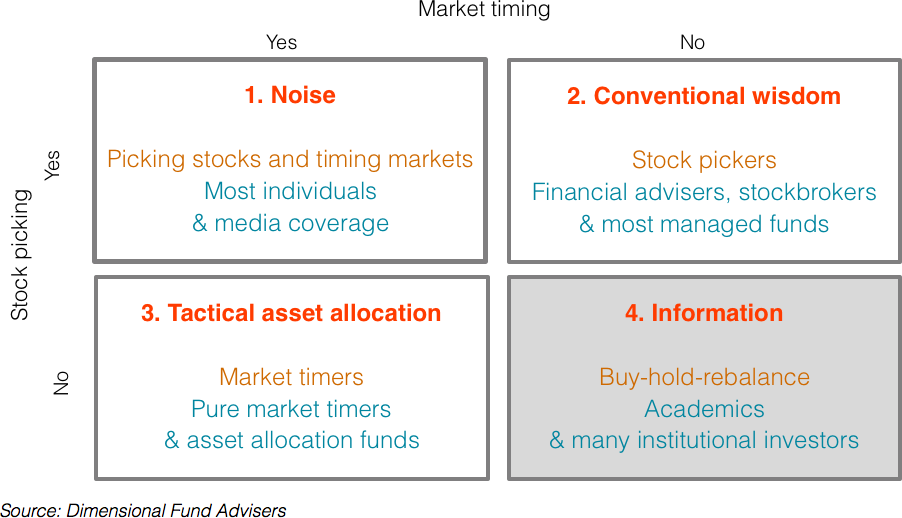

In investing, there are two main sources of potential returns. The first is the return that comes from the markets and the second is the return generated through an investor’s skill. At its simplest, there are two main ways in which an investor can try to deliver a better return than the market return; time when to be in or out of the markets (known as market timing, tactical asset allocation or sometimes a ‘top-down’ approach), or to pick individual stocks (known as stock picking, security selection or sometimes as a ‘bottom-up’ approach). This gives us the four main combinations of strategies set out in the figure below.

Figure 1: Four main strategies exist – they are not equal in effectiveness

Trying to beat the market – through either market timing or stock picking – is a tough game, with very few winners, and in our view is not a game worth playing. That positions our own approach in the bottom right quadrant, where we and other sophisticated investors use the information in the empirical evidence to employ an approach with the greatest chance of delivering a successful outcome. We avoid trying to market time or pick stocks. We just let the markets do the heavy lifting.

Letting the markets do the heavy lifting on returns will take a great weight off your shoulders; you no longer need to worry about picking the right stock, the right manager or deciding if you should be in or out of the markets. We are always happy to chat about some of the overwhelming empirical evidence in support of our approach, so if you feel you want to know more then call us on 01869 331469.

Recent Comments