As you grow older, it’s possible you will have surplus income. You’ll have income from your pensions and interest from your savings, while at the same time, your expenditure may be reduced.

This surplus accumulates, either as cash or investments, compounding any existing inheritance tax (IHT) you may have. Understandably, you’d rather that any excess income goes to your loved ones than to the taxman.

Spending your money is one obvious way of reducing your surplus income. Make sure you’re living a comfortable retirement and doing all the things you’ve dreamed of.

But after that, the simplest way of reducing a potential IHT bill is to give your money away while you’re still alive. And while you may be familiar with the main gifting rules, you may not be aware of ‘gifts from income’.

Let’s explore how they can form an important part of your strategy for reducing your IHT plan.

Inheritance tax explained

Soaring property prices and frozen tax thresholds mean many more families may have to pay IHT, i.e. 40% tax on any wealth they inherit. In fact, according to HMRC forecasts, an additional 49,400 households will have to pay the tax by 2027.

The current rules allow you to leave an estate worth £325,000 without it being subject to IHT. This is known as the nil rate band. If you’re also leaving a home to your children or other direct descendants, there is an additional transferrable main residence nil rate band of £175,000, if you meet the criteria.

This can take your total allowance to £500,000, and it is transferable to your spouse when you die or vice versa. So, it’s possible to leave up to £1 million without triggering IHT.

Gifting rules

A sensible way to provide for your loved ones while reducing your estate’s exposure to IHT is to make financial gifts. But you must understand how much you can give.

You’re allowed to give £3000 each tax year without it being added to the value of your estate. This can be to one person or split between several individuals.

You can also carry forward the previous year’s allowance if you didn’t use it, making £6000, but only for one tax year.

In addition, the small gift allowance enables you to make as many gifts of up to £250 to different people as you would like, as long as they haven’t benefited from another gifting allowance.

Plus, there are special allowances for weddings, which means you can give a child £5,000 when they marry, £2,500 to grandchildren or great-grandchildren, or £1,000 to anyone else. You can combine this with the £3000 annual exemption, just not the small gift allowance.

What are ‘gifts from income’?

You can make unlimited ‘gifts from income’, irrespective of how long you live after making the gift, and don’t need to worry about IHT. These are regular payments to another person, known as ‘normal expenditure out of income.’ They could be used to:

- Pay rent for your child

- Help someone with their living costs

- Pay into a savings account for a child under 18

- Give financial support to an elderly relative

- Make regular gifts into trust.

- Fund life policy premiums

- Make regular pension contributions for a family member

There are just certain criteria you need to bear in mind. The gifts need to:

- Be habitual – HMRC will check back over three or four years to see if the gifts were made consistently.

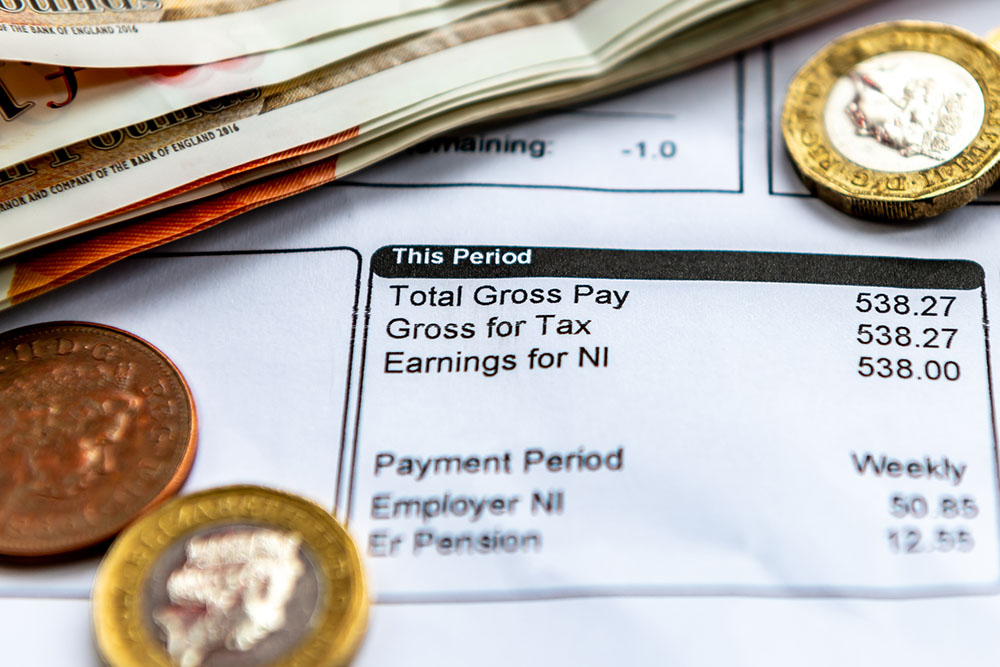

- Come out of your income – the payments must come from pension income, employment, dividends, or rental income, not from your capital or a house sale.

- Maintain your usual standard of living – you should be able to afford the gifts once you’ve paid for your normal outgoings, such as bills, food and personal spending.

Ideally gifts should be of a similar size to make them more easily identifiable as from surplus income. The taxman may allow gifts of different amounts if your income is variable or the gifts cover costs that change, such as school fees.

‘Gifts from income’ is a valuable strategy as it enables you to help your family and see them get the benefit of your wealth before you pass away.

Take the example of a child struggling to pay their mortgage. Giving them £550 a month for a period of three years would reduce your estate by £19,800. As well as easing their immediate money worries, it could also save them £7,920 in tax later.

Note, if you’re giving gifts to the same person, you can combine ‘normal expenditure out of income’ with any other allowance, except the small gift allowance.

Implementing a ‘gifts from income’ strategy

There are a few steps to follow if you’re going to take advantage of the ‘gifts from income; exemption.

Make sure you assess your total income from all your different sources. Be aware that the five per cent annual allowance from an investment bond doesn’t count as income.

Evaluate your living costs so that you have a clear understanding of your monthly and annual expenses. That way, you can be sure your gifting income is genuinely surplus.

Set up regular payments, such as a standing order, to your chosen recipients so you don’t miss a payment and can be confident your giving is consistent.

Keep detailed records of your income, expenditure and the gifts you have made. This will help your beneficiaries prove to HMRC that your gifts were made from surplus income and did not affect your lifestyle.

The seven-year rule

‘Gifts from income’ and the other allowances outlined above are exempt from the seven-year rule, but remember that any other money you give away will still be included in your estate for tax purposes unless you live for another seven years.

They will be considered a potentially exempt transfer (PET), which means the amount of IHT you pay on them reduces over time until seven years have passed and the gift becomes totally tax-free.

Forming your IHT plan

Over time, employing a ‘gifts from income’ strategy can take large amounts out of your taxable estate and reduce the amount of IHT your loved ones eventually pay (out of your assets).

It can make a considerable difference to the amount they receive now, compared with what they would get once you’ve died and 40% tax has been deducted.

It’s worth seeking professional help if you’re considering ‘gifting out of surplus income’ to ensure your strategy is tax-efficient and compliant with HMRC guidelines.

That way, you reduce the risk of any disputes following your death. Do contact us if you’d like any help or guidance with this aspect of your IHT planning.

Recent Comments