Jeremy Hunt delivered the Autumn Statement on 22 November following weeks of speculation about potential tax cuts. The headline measure, a reduction to National Insurance Contributions was something of a surprise. Beyond this, economic measures are looking more positive than indicated in March, and the government has committed to continue investing in businesses to boost growth.

The main measures announced are covered below.

The Economy

- Inflation is expected to reduce to 2.8% by the end of 2024.

- Overall, the rate is expected to stay ‘higher for longer,’ and is unlikely to drop to the Bank of England’s 2% target until 2025, a year later than previously predicted.

- Based on this, it is suggested that the base rate will remain at around 4% until 2028, rather than dropping to 3% as previously indicated.

- It is anticipated that the economy will grow by 0.6% this year and 0.7% next year. Incremental growth of 1.4% – 2% per year is expected over the following four years.

- Overall, the economy has grown by 1.8% since before the pandemic.

- In March, it was predicted that the economy would shrink by 0.2% this year, before growing at a higher rate than currently predicted. This suggests slower growth from a higher starting point than previously predicted.

- Government debt is projected at 94% of GDP, which is lower than predicted in March.

- The budget deficit, or difference between spending and income, is currently 4.5%.

- Public borrowing is estimated at 5.1% of GDP, or around £132 billion.

- While these figures are an improvement from March, it is likely that there will be little difference in long-term projections due to the additional cost of the measures announced.

Personal tax

- The main rate of employee National Insurance Contributions are to be cut from 12% to 10%. This will take effect from 6 January 2024.

- Class 2 National Insurance, payable by self-employed people at a rate of £3.45 per week, will be abolished.

- Self-employed people will also see a 1% cut to Class 4 NI contributions, from 9% to 8%.

- Both changes to self-employed rates will take effect from April 2024.

- There were no changes to Inheritance Tax, despite discussions in the preceding weeks.

- Alcohol duty will be frozen until August 2024 while tobacco duty will increase at 2% above inflation (12% above inflation for hand-rolled tobacco). No changes to fuel duty have been announced.

Pensions

- A pension ‘pot for life’ will be introduced. This is intended to give employees more choice over where their pensions are invested and reduce the number of ‘small pots’ accumulated over the course of a working life.

- The State Pension ‘triple-lock’ was re-affirmed, with an increase of 8.5% to retirement income from April 2024.

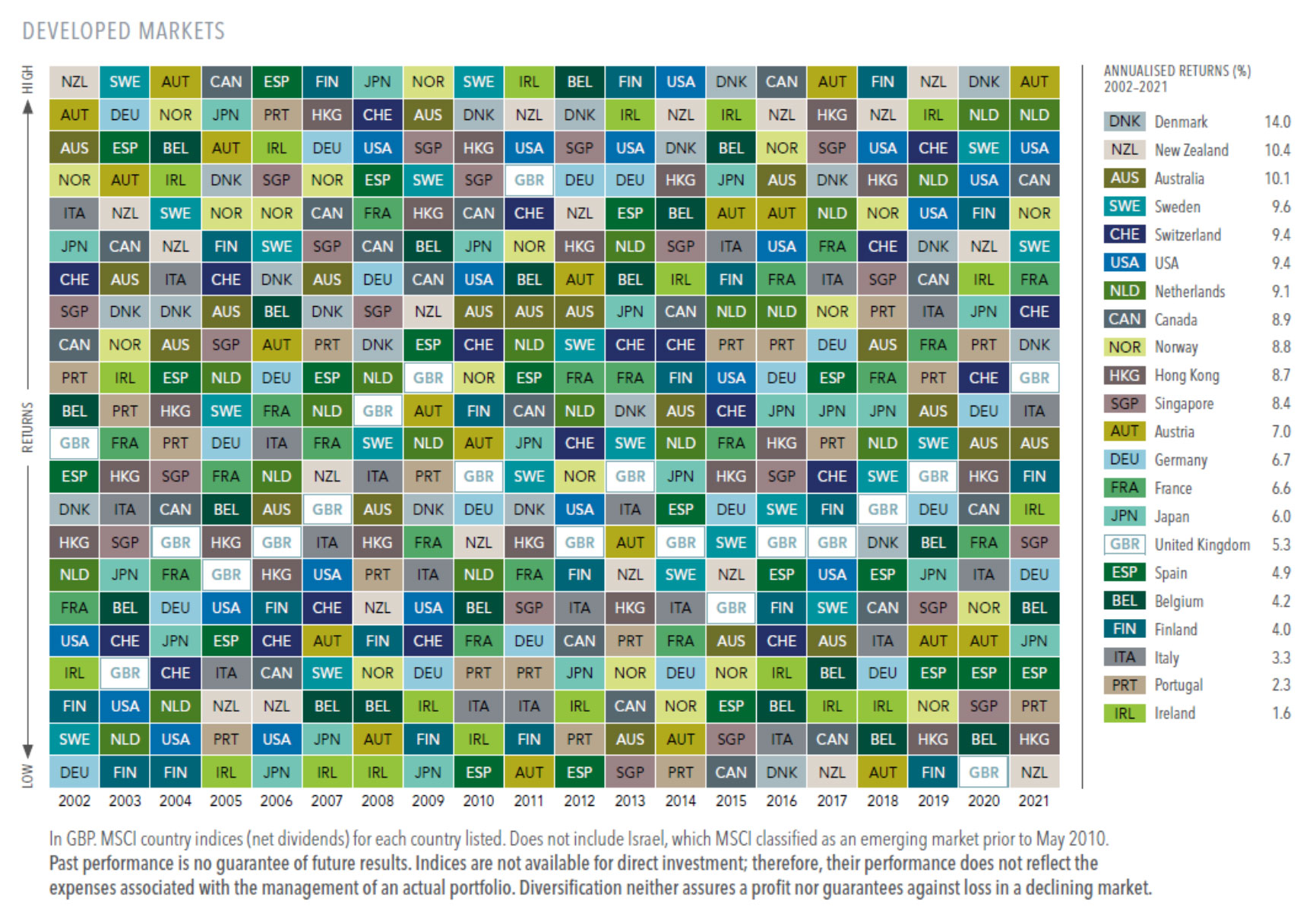

Investments

- Currently, ISA investors can contribute to one cash ISA, and one stocks and shares ISA. From April 2024, this restriction will be removed. The contribution limit will remain at £20,000 per year.

- The scope of investment choice for ISAs will also be widened to allow access to ‘long-term asset funds,’ which invest in illiquid assets such as property and private equity.

- The government has committed to extend the tax advantages of Venture Capital Trusts and Enterprise Investment Schemes to 2035. This change follows a post-Brexit consultation as these investments did not align with EU rules.

Energy Crisis

- Anyone living near new pylons and transmission infrastructure could be offered up to £10,000 off their energy bills over the next 10 years.

Business

- Temporary measures allowing businesses to offset the cost of capital investment in the company (for example, by purchasing new equipment) will be made permanent.

- Business rates will be discounted for hospitality, leisure, and retail businesses.

- The government plans to invest £4.5 billion in manufacturing and £1 billion in aerospace/green technology between 2025 and 2030.

- New investment zones will be introduced in Wrexham, Greater Manchester, the West Midlands and the East Midlands.

- £80 million will be directed towards new levelling up projects in Scotland.

- It is hoped that the total package of measures for businesses will increase investment by up to 1% of GDP.

- The government is considering a sale of its remaining stake in NatWest Group following the bank’s bail out in 2008.

Property

- New rules are under discussion which would allow existing houses to be converted to two flats, providing the exterior of the property is unchanged. This is intended to increase the number of homes available.

Work and Benefits

- The National Living Wage will increase to £11.44 per hour from April 2024. This will be extended to all workers aged 21 and over.

- The rate will increase to £8.60 per hour for 18- to 20-year-olds.

- Universal credit and other benefits will increase by 6.7%, equivalent to September’s inflation rate. This represents an average gain of £470 for 5.5 million households.

- Local housing allowance is to be increased, with an average raise of £800 for £1.6 million households. These rates have been frozen since 2020, despite average rental increases of over 30%.

- Anyone claiming unemployment benefits will need to undertake mandatory work experience if they do not find a job within 18 months. If they do not actively look for work, benefits will be stopped.

- £1.3 billion will be allocated over the next five years to help people with health conditions get back into work.

Public Services

- £14.1 billion has been pledged for the NHS and adult social care, while schools will receive £2 billion in the current and next tax years.

- Defence spending will remain at 2% of national income, with overseas aid spending falling 0.2% below target at 0.5%.

How Will You Be Affected?

If you are employed or self-employed, you can expect your net income to increase due to the reduction in National Insurance. Anyone receiving an income from pensions or investments will not be affected by this change.

Lower earners may benefit from the increase to the National Living Wage, particularly as this has now been extended to anyone aged 21 and above. However, despite the increases to benefit payments, the likelihood is that anyone claiming benefits will face increased pressure to find work, whether this is feasible or not.

While pension savers may eventually benefit from the ‘pot for life’ concept, the reality is many years away and concrete details are not yet available. It has been pointed out that investors can already set up pension schemes independently of their employer and that perhaps more guidance would have a greater impact than a brand-new pension system.

Conclusions

After weeks of speculation about a reduction to Inheritance Tax, the cut to NI rates was unexpected. However, this will offer more benefit to the average worker versus a tax cut on large estates.

Criticisms for the measures from Labour were limited and mainly focused on the idea that it was too little too late. The NI cut has been generally welcomed, but it was felt that it did not begin to compensate for frozen thresholds and stealth taxes.

Please do not hesitate to contact a member of the team if you would like to discuss any of the topics covered.

Recent Comments